Introducing

Experience Ecosystem

Designed by Very Human Studio

Design Statement

The Experience Ecosystem reimagines physical retail through responsive recommendation, providing customers with a more informative and experiential way of shopping.

Meet Very Human Studio

From left to right: Yiwen Zhao, Jasmine Hsu, Olaf Kamperman, Yixiao Zhang

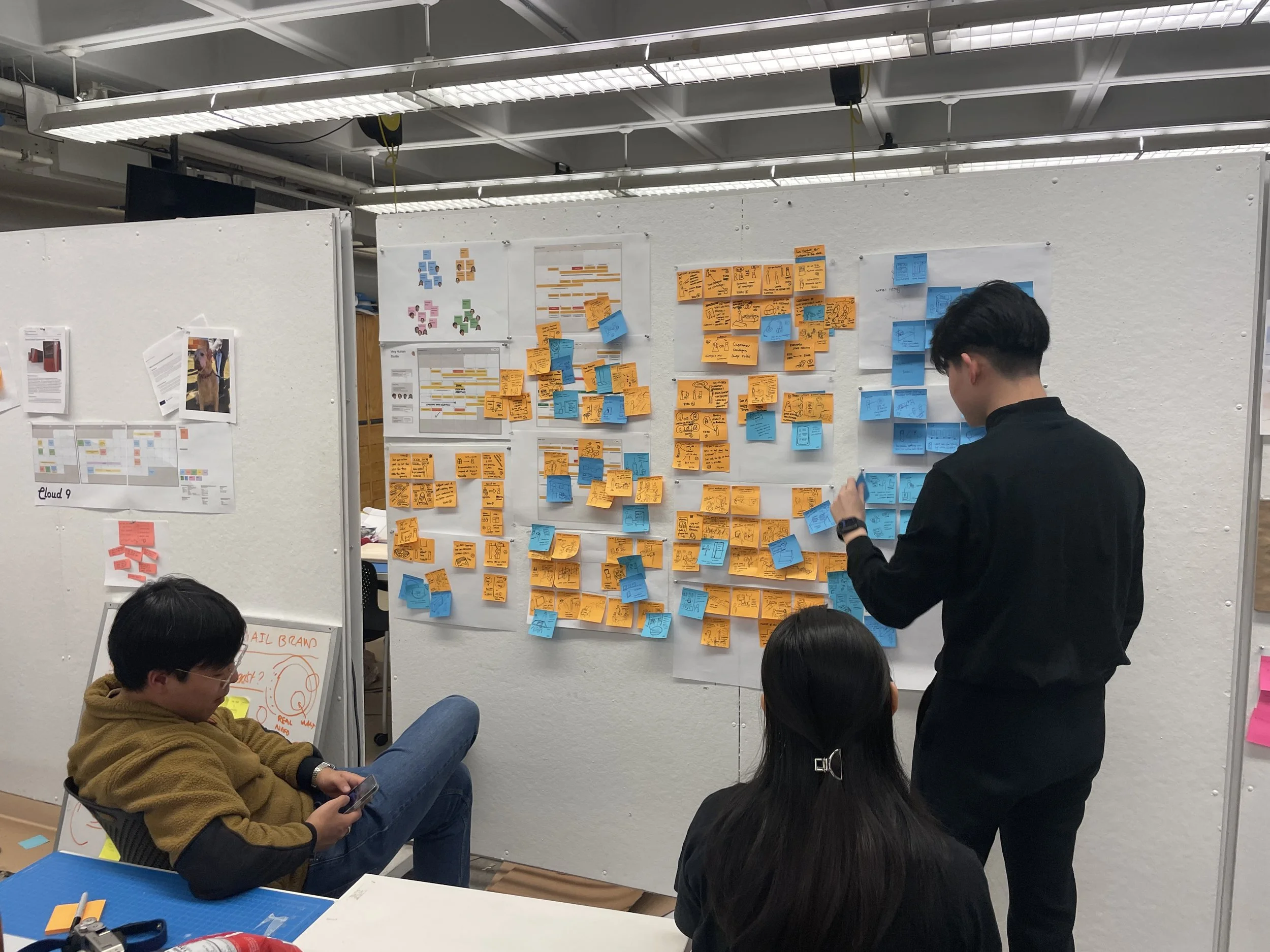

In the spring semester of 2024, my group in the Interactive Product Design Studio, known as Very Human Studio, was tasked with envisioning the future of the retail experience in a collaborative project sponsored by Cognizant. We explored the current challenges in electronics retail space and designed what we believe to be the future of the in-person electronics retail experience: The Experience Ecosystem.

Design Process

1.

4.

7.

8.

2.

5.

3.

6.

Understanding Retail

Why redefine the retail experience?

The best way to understand the current challenges customers face while shopping is to experience it firsthand. Having conducted several contextual inquiries for different customers, here is a visualization of the current retail experience that people face:

Scoping the Problem Space

Asking the questions that are worth asking

The above storyboard consolidates the pain points we identified during user research. To reach this consolidation, we first utilized multiple research methods on a diverse range of subjects. At the beginning of the research phase, we aimed to explore as broadly as possible, examining various dimensions of the overall retail space before deciding on one specific area to focus on.

Secondary Research

12

Academic Papers

28

Articles

Observation

16

Stores

4

Retail Centers

Interviews

11

Employees

7

Customers

Survey

45

Responses

12/33

Male/Female

First, we generated a system map that helped us to understand the problem as a system. Our map explores the key stakeholders and touch points in retail and the connections between them, with stronger or more frequent interactions marked by heavier line weights. For the most influential and descriptive parts of the system, we described their motivations and challenges to deepen our understanding of the retail space.

In our system map, the customers are at the center of everything; everything revolves around them. They are connected to the majority of the actors and stakeholders and have the most significant influence over them. Additionally, they are the most complex due to the diversity of the people and their unpredictability. Therefore, we wanted to dig a little deeper into the retail customers by identifying some key personas.

We placed certain personas that we identified on a chart where the x-axis represents their intent to purchase and the y-axis indicates their familiarity with the brand. Ultimately, we identified a spectrum: on one end is the "wanderer," who has low intent and varying degrees of brand familiarity, and on the other end is the "hunter," who has high intent and high brand familiarity. Using this framework, we were able to narrow down which personas to focus on for scope and research purposes.

Need-Finding

Answering the questions that were proven to be worth answering

1.

2.

A customer’s level of exploration is a reflection of the clarity of their shopping intent.

The intentions of a customer directly correlate with how much they are willing to engage with the store itself. In this context, clarity refers to their understanding of their own needs. For example, those with an unclear perception of their needs are more likely to stop and interact with products, even if they have high intent, because they might not be completely sure of what they are buying. In our interviews, we found that some customers described their retail experience as very exploratory, while others, who were much clearer about what they wanted, did not engage in this act of exploration. We found examples of stores that catered to these differing levels of clarity. For instance, in a local bookstore, there were no labels, and the products were spread out to encourage people to stop and look around. In contrast, at a Target, the aisles are clearly labeled and help centers are designed to assist customers in finding something as quickly as possible.

Customers value employees for their expertise. Employees value personal interactions with customers.

Because customers and employees have different reactions to asking for help, we concluded Insight Two with two perspectives: On the customer's side, they appreciate the employees' expertise and knowledge about the products and services. On the employee's side, while many enjoy providing high-quality information, many also mention that having personal connections and prolonged communication with their customers is what they value most.

2.

Customers are sensitive to the way their personal data is presented back to them.

This means that very few customers are constantly aware of how brands use their data and whether it is being collected. They are usually concerned about data privacy, but crucially, only when confronted with it in an uncomfortable way. It seems that customers are most comfortable on either end of the human-tech spectrum, where either an invisible algorithm or a person feels acceptable, but something trying to be both—like an AI system fully replacing an employee—can come off as creepy. The lesson here is not that customers are uncomfortable with data-based personalization per se, or that brands should completely hide all their data collection efforts; rather, it's that the manner in which data collection and personalization are presented and implemented matters significantly.

Opportunities

With our insights, we redrew our journey map and identified the areas in the journey that each insight corresponds to. With that, we were able to identify three areas of focus in the user journey: look for item, item interaction, and checkout.

Concept Development

Taking a glance at the future of retail

With three focus areas in the customer's journey, we have developed a conceptual framework that allows us to generate ideas with greater breadth. We have created a 3x3 chart where each column represents the scale of the concept, ranging from hand-held to store-wide. The rows represent the three focus areas we have identified in the user journey map. Using this framework, we can generate concepts without becoming too tunnel-visioned and neglecting other important aspects of the retail experience. For example, we might ask ourselves, what would a hand-held scale product look like that improves the way people check out? Or, what would a store-wide ecosystem look like that could help customers interact with products better? Using this framework, we have been able to generate over 120 ideations.

HMW

How might we combine the convenience of online shopping with the physical experience of in-store retail?

Then we narrowed down our 120+ ideas into 12 concepts for further critiques and feedback from fellow classmates and designers from Cognizant. We have produced a total of 12 concepts to showcase during the concept check. But we didn’t really see a clear direction from any of the concepts in particular at that point. So we identified what part of the concept we liked the most. As a result, we want to create something that utilizes the in-store algorithm to provide a personalized experience and present the personalization through a physically dynamic and activating system.

Initial Consolidated Concept

There are two levels of recommndation the experience hubs give to users. First, customers are presented with generic recommendations based on item popularity or what the store wants to sell, with recommendations being presented in a physically dynamic way. As customers interact with the products, based on which things they select and how long they use them for, the hub learns and adapts its recommendations.

The experience ecosystem retains the big traditional in-store benefit of being able to touch the products, to get a sense of material, weight, and scale. What’s new about the experience hubs that isn’t exactly available online or in-store currently is the guided and responsive product testing screens. The hub senses when you have picked an item up, displays information about it on the screen, and starts walking the customer through some of the product’s best features.

With our Experience Ecosystem, we’re ultimately able to provide a level of convenience that is beyond one’s imagination. With our store layout, we allow the freedom for our customers to seamlessly transition between different ways they want to shop. Ultimately, we’re able to provide customers a experience that is efficient without compromising exploration.

Concept Test

Testing the vision with real customers

Research Goals

1.

Identify the best way to present recommendations to customers at Experience Hubs.

Research Questions

1.

2.

3.

1.

2.

3.

4.

What are the ergonomics of the different product information displays? How do people prefer product information to be presented to them?

What is the ideal user flow to showcase recommendations?

How do customers switch from more explorative to goal-orientated mindsets during the retail experience?

How do people expect help during the shopping experience?

Hypotheses

Users feel that the Experience Hub is an individualized experience.

Users do not want a fully autonomous experience.

The Experience Hub recommendation system is helpful for product selection.

Users want a localized display for product information.

Participants

9

Participants

Average Session Time in Minutes

Tasks Performed

We asked our participants to perform three overarching tasks. We made them to walkthrough their shopping experience using the small-scale model. We then asked them to find a pair of headphones to purchase by interacting with the experience hub. Then we asked them how they would go about checking out.

2.

vs.

Discover the relationship between recommendation effectiveness and user mindsets.

38

3.

Understand how necessary employee interaction is to the checkout process.

5

Majors

Specifically with the interaction of experience hub, we conducted a A/B test where we wanted to see which product display methods works the best with the hub design. The centralized display features a big screen in the middle and the localized display shows product information right next to the individual products.

Test Findings

3.

Affinity Map

1.

2.

3.

Users want product information to be close to the corresponding product.

Our first insight, which came from our A/B testing of how to present product information, is that users want product info to be displayed close to the corresponding product. People preferred local information over centralized info, with people valuing focus of information and having trouble looking back and forth between product and central screen. Specifically, we have several participant kept having to look back and forth between the product and the information on the big screen.

The Experience Hub recommendation system does not support a user’s exploration.

Second, what we found from testing our recommendation system was that in its current version, it doesn’t contribute to people’s in-store exploration. This was pretty consistent across most of our tests when we pushed products out at people, where some completely ignored it, most were at least initially confused, and a few thought it helped. Specifically, we have several participant clearly sees the initial recommendation, then proceeds to completely ignore it and go for a different product.

The affordances of Experience Hubs do not support self-checkout.

Third, from our last, more abstract section of our tests, we discovered that experience hubs do not afford self-checkout in their current form. Essentially, people did not expect to be able to checkout at the experience hub even when told they could do so. We saw that people expected to go find an employee, or get a boxed product from the hub to go and take to a different checkout station, but overall most saw the experience hub as primarily for experiencing products, with checkout as a separate process. One participant shows how, if he decided to buy something, he would leave to get an employee and bring them back to the hub to help checkout.

Users expect the Experience Hub to be a private retail process.

Lastly, from both the full-scale and small scale portions of our tests, we found that users expect the experience hub to be a private retail process. Though many had logistical concerns about only having one group of people per side of the experience hub, from the experience of the full-scale form and concerns about the privacy of their recommendations, most of our participants would prefer the experience hub to be a private experience and feel it is meant to be that way. Several participants expressed how the curved form made it feel like the private experience, especially compared to the scale of the people in the small-scale model. Others, when being shown the recommendation and product info features in the full-scale model, said they would feel strange if other people saw those and expected recommendations to be unclear if multiple people were at the hub at once.

Design Decisions

Decisions based on insights

1.

2.

3.

4.

5.

Use localized display as the primary method for product information presentation.

Insight 1 shows the necessity of displaying product information in a handy way. Some possible directions will be projecting information beside the product, or utilizing centralized and local displays for different purposes.

Develop a stronger indicator for each product recommendation.

Because test participants ignored the push-out moment frequently, this decision allows us to use indicators such as lighting or sound to catch user’s attention.

Display justification for each product recommendation.

The experience hub needs to provide the users a clear justification when a product gets recommended. For example, when a pair of headphone gets pushed-out to the user for the first time, the user will see “We’re recommending this headphone model because it’s our best-seller in the store.” and we believe user will less-likely to be confused by the recommendation system.

Modify the Experience Hub to conform to existing mental models of checkout.

Users will have the freedom to choose their preferred check-out methods, either at the checkout counter or self-checkout. Boxed new products can be available in or around the EH to streamline this process.

Focus on the individual shopper at the Experience Hub.

The shape of EH and test participants’ feedback shaped this decision. For upcoming iterations, we would like to focus on using store layout to guide and support a private experience.

User Values

Upon the five decisions, we are able to provide the user a streamlined information representation, a personalized and private experience at the EH, and eventually an adaptive retail journey for various user needs.

Final Design

Welcome to the future of retail experience

Rex’s Retail Experience

Want to experience the future of retail firsthand?

You can experience the store layout of the Experience Ecosystem with a computer, a phone, or a VR headset. Click on the link below to enter the future of retail!